Ifrs 16 depreciation calculation

Jennifer has over 16 years of experience in audit and technical accounting. Identification of a lease contract.

Ifrs 16 Leases Best Complete Read Annual Reporting

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today.

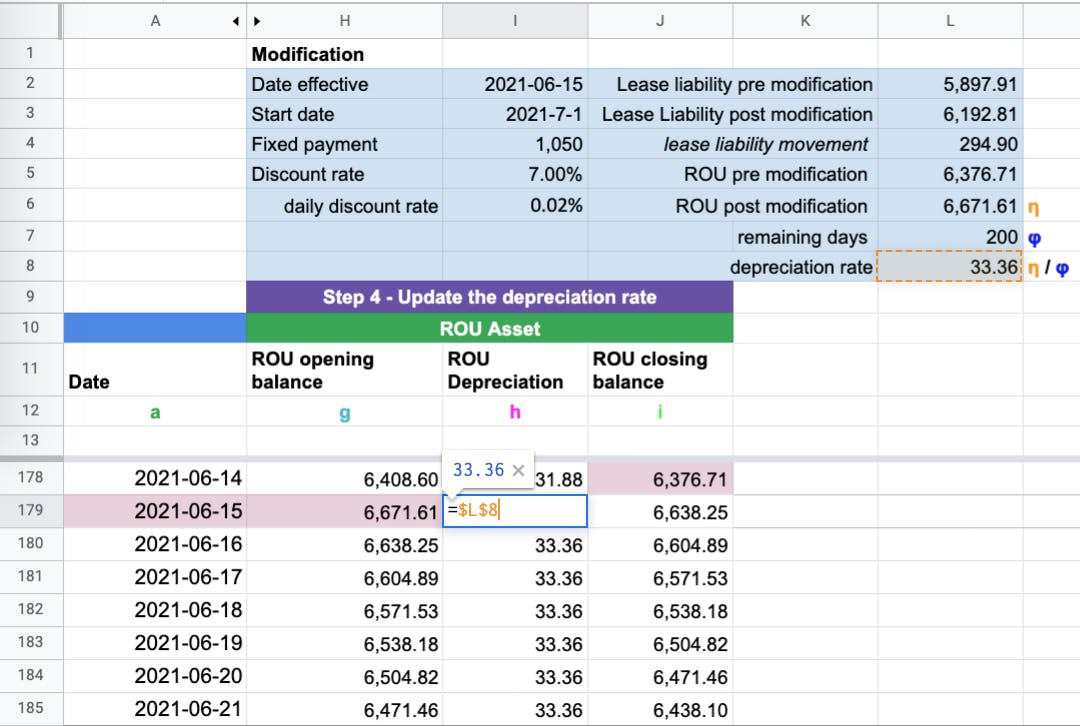

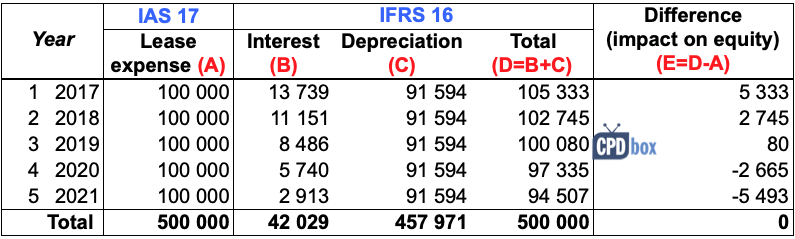

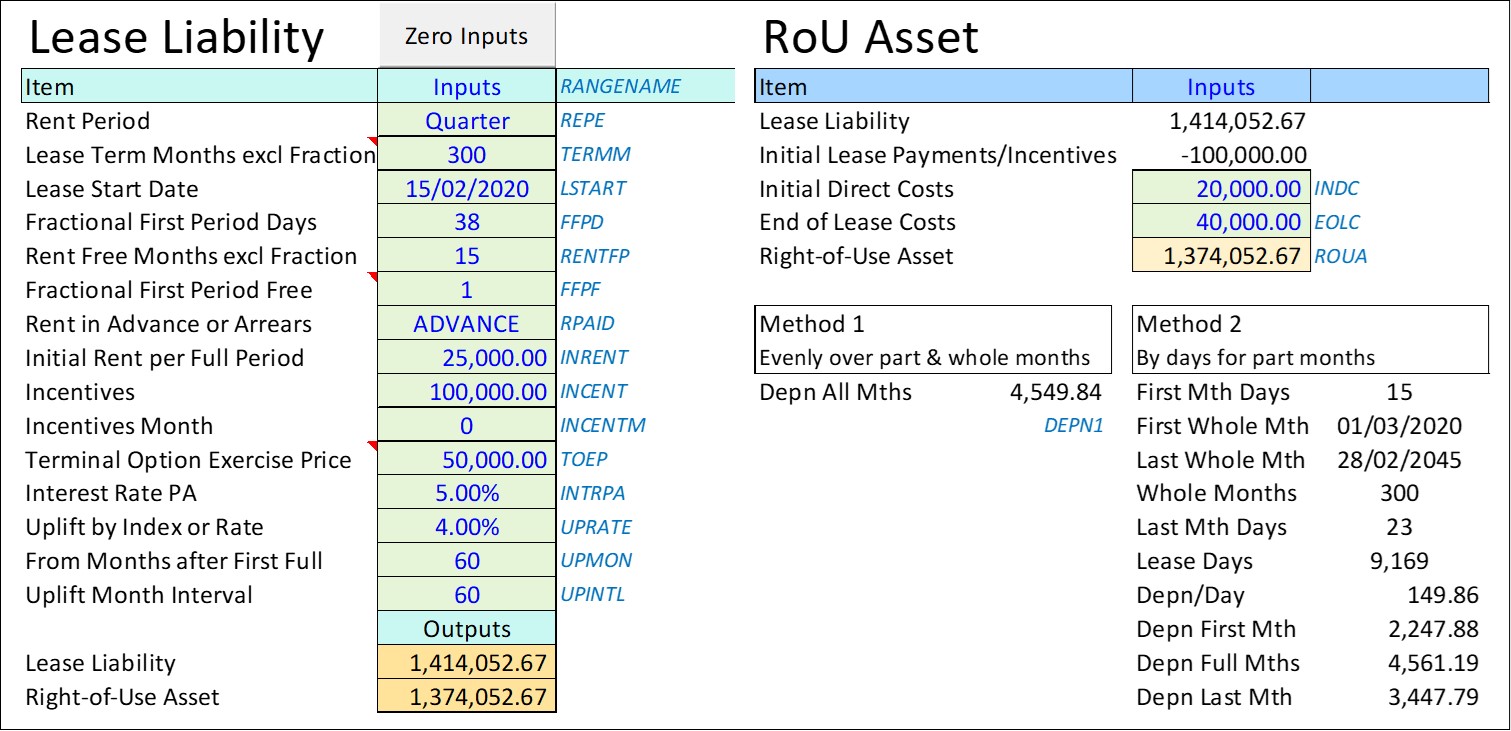

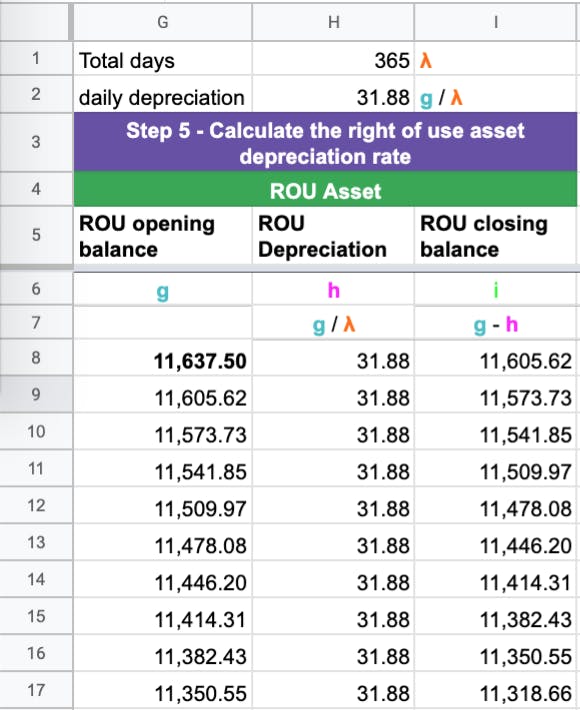

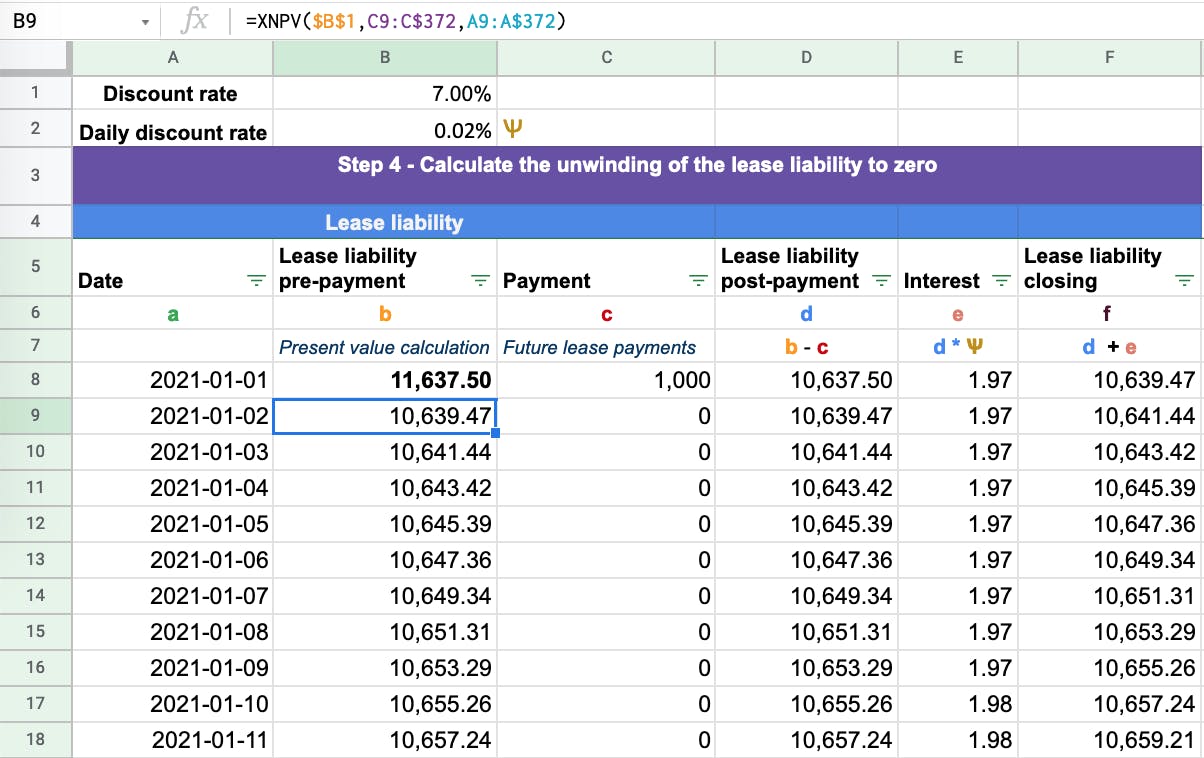

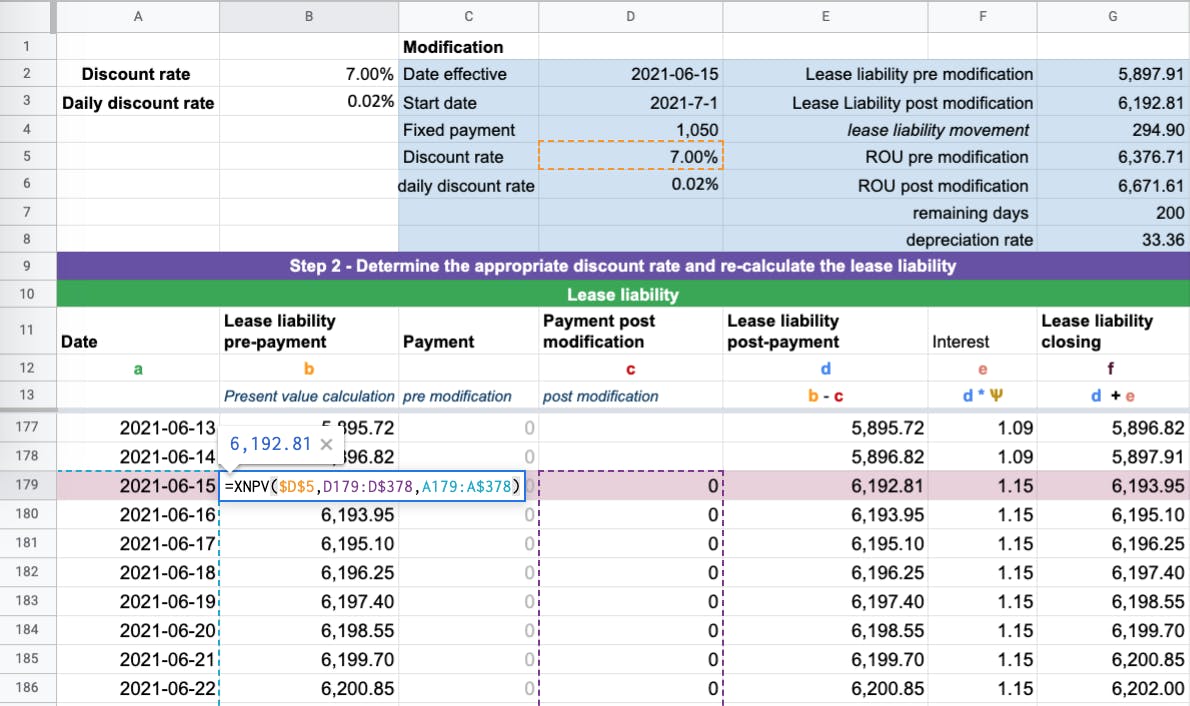

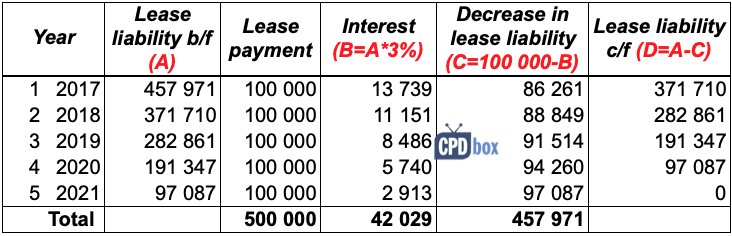

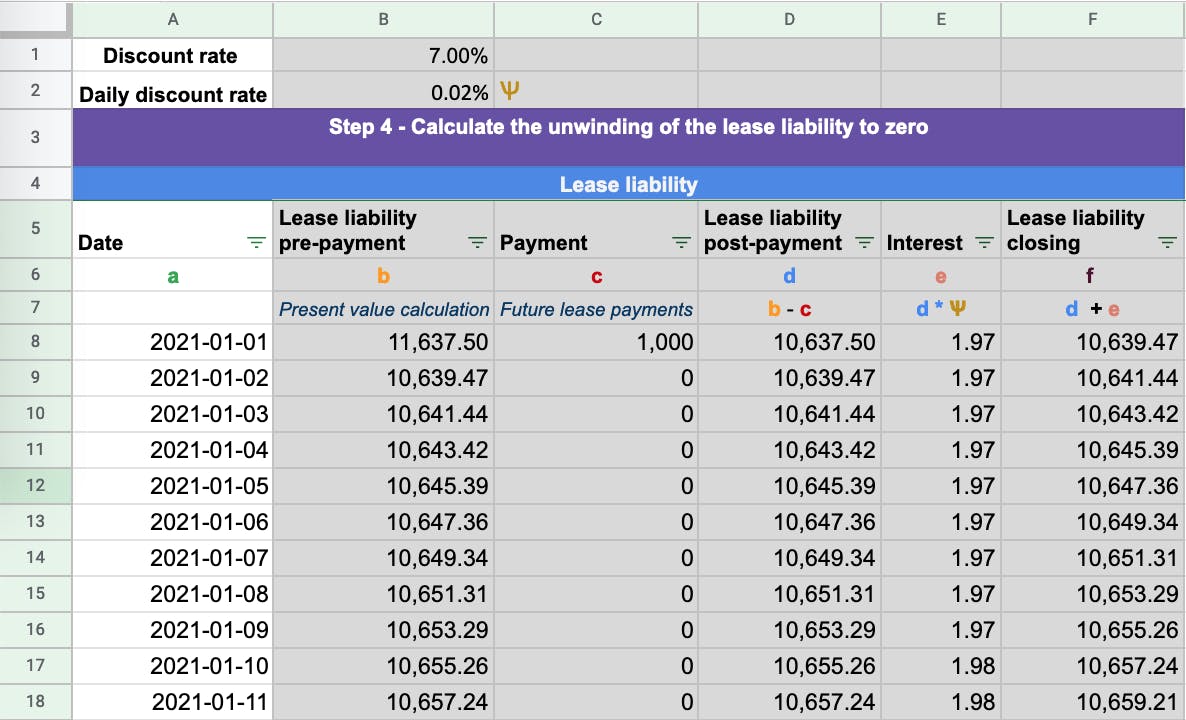

. Calculations IFRS 16 Leases Effective quarterly interest rate 1 total annual rate number of compounding. Illustration of application of amortised cost and effective interest method. The 5-step lease calculations model.

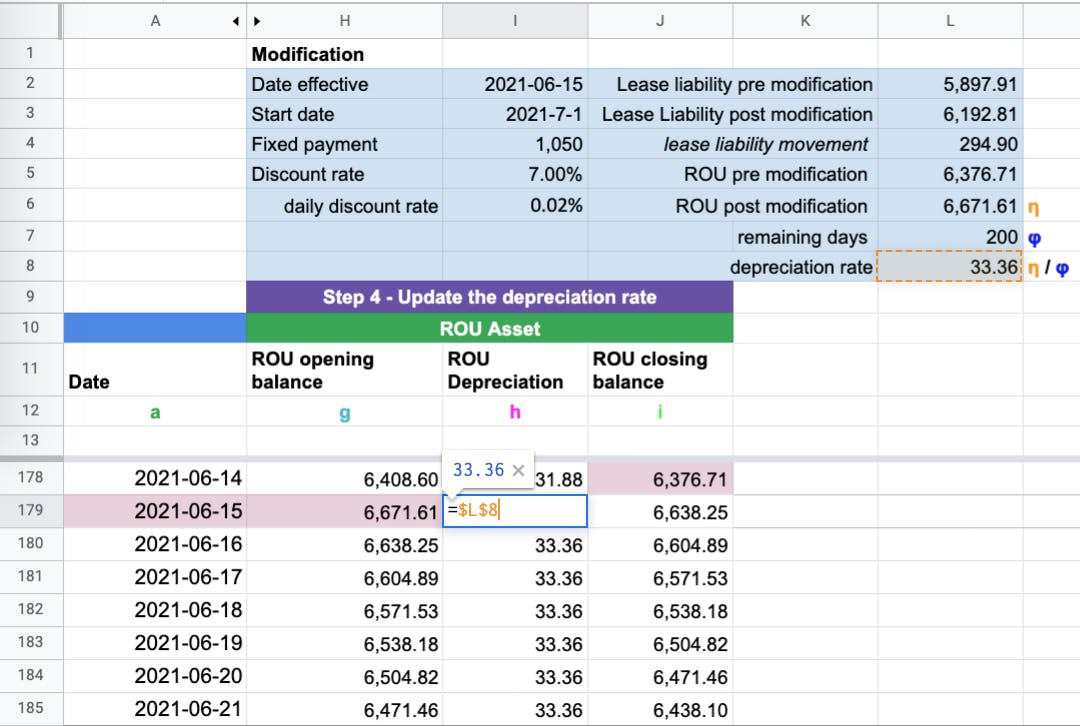

Step 2 Lease term. To perform depreciation calculation first we must find the depreciable amount. IFRS 9 excel examples.

This is perhaps the most simple calculation required for our IFRS 16 workings and is done by simply dividing the opening RoU asset by 3 to get the annual depreciation. Ad QuickBooks Financial Software For Businesses. Lease Options to Extend or Terminate.

The amendment addresses the issue in paragraph 35 of IAS 16 and paragraph 80 of IAS 38 by clarifying that. IFRS 16s stated goal is to ensure that lessees and lessors provide relevant information in a manner that faithfully represents those transactions and give users of. Jennifer has over 16 years of experience in audit and technical accounting.

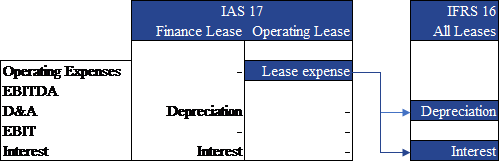

Such idle periods occur. Revision of cash flows in amortised cost calculation. IFRS 16 Valuation Impact What you need to know now 1 We note that companies with net cash positions have been excluded from this net debtEBITDA analysis.

Get QuickBooks - Top-Rated Online Accounting Software For Businesses. The determination of the accumulated depreciation does not. The interest conversion is calculated using the formula.

2This is based on the. The interest cost of 55056 will be taken to the statement of profit. In addition it will be necessary to adjust the asset for any new measurement of the lease liability as we will see in example number 3 of this article.

Appendix A Interest rate implicit in the lease The interest rate that yields a present value of a the lease payments and b the unguaranteed residual value equal to the. Ad QuickBooks Financial Software For Businesses. Rated The 1 Accounting Solution.

Re-estimation of cash flows in floating-rate. Depreciation charge for that period reflects the consumption of the assets service potential that occurs while the asset is held IAS 16BC31. About IAS 16 establishes principles for recognising property plant and equipment as assets measuring their carrying amounts and measuring the depreciation charges and impairment.

This is a single choice that must be applied to all leases Option 1 Retrospective Restate comparatives as if IFRS 16 always applied Option 2 Cumulative catch-up Leave. Rated The 1 Accounting Solution. Depreciable amount Cost of an asset residual value It is important to remember that.

Ad Schedule A Free Demo With The Lease Accounting Experts At LeaseQuery Today. The IFRS Foundation is a not-for-profit public interest organisation established to develop high-quality understandable enforceable and globally accepted accounting and. Get QuickBooks - Top-Rated Online Accounting Software For Businesses.

At the end of year one the carrying amount of the right of use asset will be 895470 942600 less 47130 depreciation.

Example How To Adopt Ifrs 16 Leases Cpdbox Making Ifrs Easy

Ifrs 16 Leases A Simple Illustration For Understanding

Ifrs 16 Calculator Tool Aoraki Analysis

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Transition Example

Example Lease Accounting Under Ifrs 16 Youtube

Ifrs 16 Leases The Impact On Business Valuations Accountancy Age

What We Do For Ifrs 16 Transition

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Ifrs 16 Leases International Financial Reporting Standard

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16

Example How To Adopt Ifrs 16 Leases Cpdbox Making Ifrs Easy

Calculations Ifrs 16 Leases Annual Reporting

Ifrs 16 Leasing Wikibanks

Owning Business Mfrs 16 Excel Computation Template And Ifrs 16

How To Calculate A Lease Liability And Right Of Use Asset Under Ifrs 16